unemployment tax break refund how much will i get

If your modified AGI is 150000 or more you cant exclude any. 100 free federal filing for everyone.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

The tax agency recently issued about 430000 more refunds averaging about 1189 each.

. Ad File your unemployment tax return free. The amount the IRS has sent out to people as a jobless tax refund averages more than 1600. Ad File Your Federal State Tax Returns With TurboTax Get The Refund That You Deserve.

Premium federal filing is 100 free with no upgrades for premium taxes. How much will I get in unemployment tax refund. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Tax season started Jan. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. If you are married each spouse receiving unemployment compensation may exclude up to 10200 of their unemployment compensation.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

If I paid taxes on unemployment benefits will I get a refund. 6 Often Overlooked Tax Breaks You Dont Want to Miss. In the latest batch of refunds announced in November however.

The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10200 tax break. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The 19 trillion Covid relief bill gives a tax break on unemployment benefits received last year. So far the refunds are averaging more than 1600.

IR-2021-159 July 28 2021. The federal tax code counts jobless benefits. The measure allows each person to exclude up to.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Learn More at AARP. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

Refund for unemployment tax break. The 150000 limit included benefits plus any other sources of income. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a.

Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. Amounts over 10200 for each individual are still taxable. They agreed to trim extended weekly jobless benefits to 300 from 400 but also to continue the federal boost through Sept.

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Earn Your Maximum Refund When You File Your Returns With TurboTax.

6 and make the. How to calculate how much will be returned The IRS is in the process of sending out tax refunds for unemployment benefits recipients who mistakenly paid tax. In the latest batch of refunds announced in November however the average was 1189.

100 free federal filing for everyone. 24 and runs through April 18. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

Generally unemployment compensation is taxable. Kiss tax breaks for unemployment benefits goodbye This means households that didnt withhold federal tax from benefit payments or withheld too little may owe a tax bill or get less of a refund. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

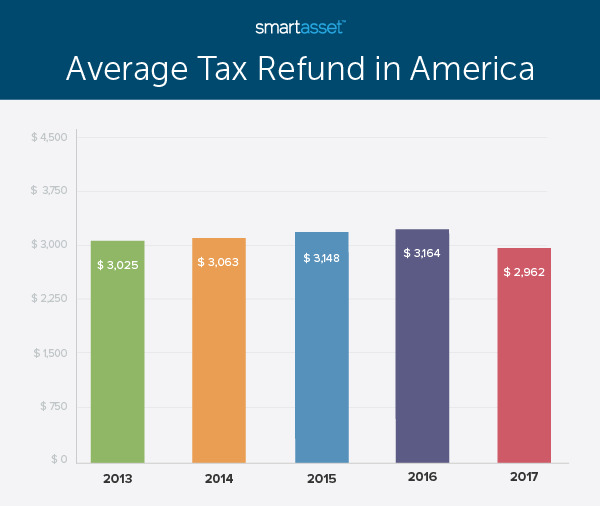

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Tax Refund Timeline Here S When To Expect Yours

Time Running Out For Ohioans Claiming 2017 Tax Refund

When Will You Get Your 2020 Income Tax Refund

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

4 Filing Tips To Ensure You Get Your Tax Refund Asap Tax Refund Income Tax Irs

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Ohio Income Tax Refund For Working From Home Gudorf Tax Group

6 456 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer 6abc Philadelphia

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands